Wiki

Run Time Calculation of Exchange gain/loss

The calculation is explained with an example below.

Company base currency is AED.

Trail Balance

Ending balance

Accounts Receivable in foreign currency

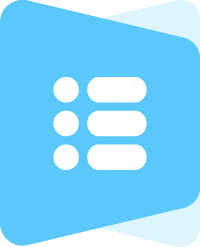

Trial balance report is generated for Jan 1, 2016 to Dec 31, 2016.

Let’s say Accounts Receivable – USD account has balance at the end of reporting period (Dec 31, 2016) –102,000.00

This amount will be converted to base currency (operating currency) with the rate of reporting end date. Exchange Rate as of Dec 31, 2016 – 1 AED = 0.2725 USD

So, Accounts Receivable – USD account’s balance in base currency (AED) will be – 102,000.00/0.2725 = 374,311.93

Next, this amount will be compared to the base equivalent of the Accounts Receivable – USD account’s USD amount. This amount will be calculated from all historical transactions. Base amount is 374,586.85

Then, system will calculate gain or loss subtracting Base Amount from Converted amount: 374,311.93 – 374,586.85 = 274.92.

This amount (274.92) will be shown as loss in Exchange Rate Gain/Loss account.

And, if Accounts Receivable – USD account has balance for the previous period (Dec 31, 2015). This amount will be converted to base currency with rate at the end date of previous reporting period. It will be Dec 31, 2015 in our case. And if converted amount is different from the amount in base currency, gain or loss will be recorded to Retained Earning account.

Foreign Bank Account Revaluation

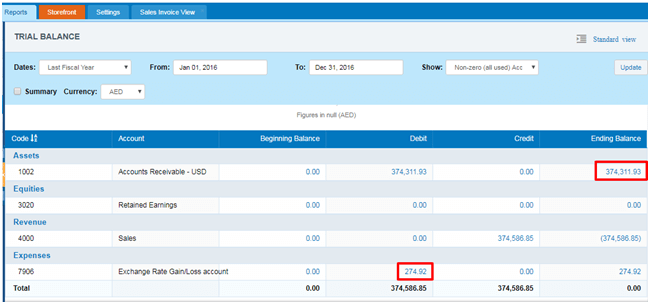

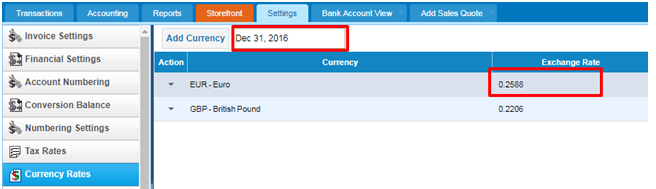

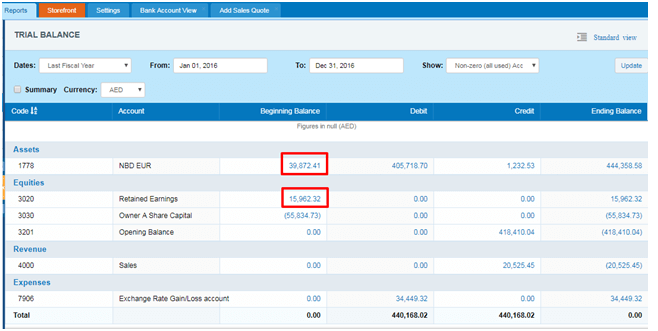

Trial balance report is generated for Jan 1, 2016 to Dec 31, 2016.

Let’s say NBD EUR bank account has balance at the end of reporting period (Dec 31, 2016) –105,000.00

This amount will be converted to base currency (operating currency) with the rate of reporting end date. Exchange Rate as of Dec 31, 2016 – 1 AED = 0.2588 USD

So, NBD EUR bank account’s balance in base currency (AED) will be – 105,000.00/0.2588 = 405,718.70

Next, this amount will be compared to the base equivalent of the NBD EUR bank account’s EUR amount. This amount will be calculated from all historical transactions. Base amount is 438,935.49

Then, system will calculate gain or loss subtracting Base Amount from Converted amount: 405,718.70 – 438,935.49 = – 33,216.79.

This amount (- 33,216.79) will be shown as loss in Exchange Rate Gain/Loss account.

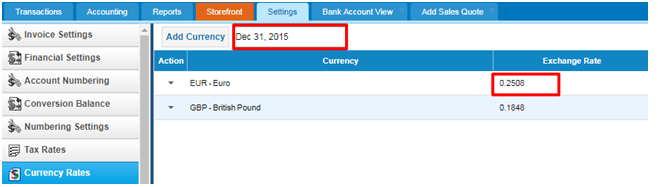

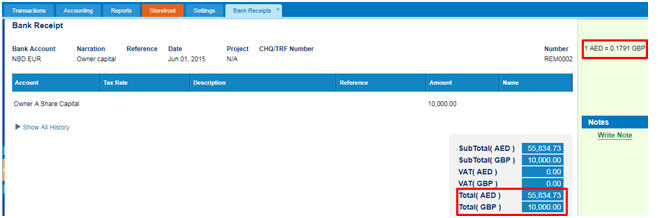

And, if NBD EUR bank account has balance for the previous period (Dec 31, 2015). This amount will be converted to base currency with rate at the end date of previous reporting period. It will be Dec 31, 2015 in our case.

EUR amount at the end of 2015 is 10,000.00 EUR. This amount will be converted to base currency with the rate of at the end date of previous reporting period: 10,000.00/0.2508 = 39,872.41

And, if the converted amount is different from the amount in base currency, gain or loss will be recorded to Retained Earning account.

39,872.41 – 55,834.73 = 15,962.32

15,962.32 – this is loss amount reflected in Retained Earnings.

See also

- Purchase Order for Fixed Assets

- Goods Delivered Notes

- Sales Quote

- Sales Order

- Sales Invoice

- Recurring Invoice

- Request for quote

- Request for purchase

- Purchase Order

- Purchase Invoice

- Recurring Bills

- Fixed Assets

- Company Expense Claims

- Employee Expense Claims

- Customer Center

- Supplier Center

- Products & Services Overview

- Bank Accounts

- Supplier Access

- VAT Reverse Charge Mechanism

- Setting Barcode for a Product

- Items Table

- Exporting to Excel and PDF

- Timesheet Invoice

- Budget per Department

- VAT Return

- Bank reconcilation

- Dividends Payable

- Assembly Products

- Add New Assembly Item

- What is Non-Inventory Item?

- Add New Non-Inventory Item

- FIFO method of inventory valuation

- What is Inventory Item?

- Add New Inventory Item

- Products/Services Import

- Add New Product/Service

- Intercompany Purchases

- Creating Intercompany Sales Invoice

- Intercompany Sales

- Workflow of Expense Claims

- Purchases / Bills Overview

- Timesheet based Invoice

- Progress Invoicing

- How to convert Sales Quote to Order, Invoice & Project

- Sales Overview

- Serial Numbers

- Accounting Overview

- Landing Cost

- Mark PO as Open

- Purchase Order Actions

- Receive Purchase Order

- Send Purchase Order

- Importing Customer Accounts