The Importance of Bookkeeping in Business: A Comprehensive Guide

Introduction to the Crucial Role of Bookkeeping

Bookkeeping is the process of keeping completed records of financial transactions and updating them periodically from time to time. It keeps records of aspects such as how much money your business owes and shall receive, what is the investment amount and the profit derived from it and such similar aspects.

The backbone of a successful business lies in its financial management, and bookkeeping plays an indispensable role in this regard. This article will delve into the importance of bookkeeping, including the significance of double-entry bookkeeping and how it can benefit your business. We’ll also cover how to get started with bookkeeping for a sound financial footing.

Table of Contents

What is Bookkeeping?

Bookkeeping involves recording and organizing financial transactions, including sales, purchases, payments, and receipts. It is the process of keeping clear and concise records so that all financial information is easily accessible when needed. Proper bookkeeping ensures that a business’s financial transactions are consistently recorded, archived, and stored securely.

When done efficiently, bookkeeping fosters accurate and well-organized data that can inform key financial decisions for business owners and stakeholders.

Aspects of Bookkeeping

Bookkeeping deals with the financial aspect of a transaction. There are various bookkeeping softwares to help you with recording the financial transactions as there are various bookkeeping tasks which need to be dealt with such as:

- Maintaining Ledgers

- Handling accounts payable and receivables

- Payroll services

- Inventory Services

- Invoice Processing

- Investment or Business advice

- Prepare for tax returns

Ready to Elevate Your Bookkeeping Game?

At KPI, we specialize in streamlining your bookkeeping and accounting processes in line with international standards. Our software will make it easy to keep your financial records in check but also propel your business towards success.

Don’t let bookkeeping woes slow you down. We also offer dedicated accountants so you can lean back and focus on your company. Take the first step towards precision, compliance, and peace of mind.

Start at just $42/month (billed yearly).

Why is Bookkeeping Important for Businesses?

Bookkeeping is not just a legal requirement; it’s the lifeblood of a business’s financial health. Below are some critical reasons why bookkeeping is important for businesses:

Make Accurate Budgeting possible

Bookkeeping is vital for budget creation as it provides an organized view of income and expenses, which helps businesses in making informed financial decisions. A well-planned budget acts as a roadmap for controlling costs and allocating resources in an efficient manner.

Accurate Bookkeeping Keeps You Prepared for Taxes

By regularly updating financial records, bookkeeping helps businesses stay prepared for tax season. Having all the financial information easily accessible keeps the tax authorities satisfied and prevents any last-minute headache during tax filings.

Maintains Organized Records

Regular bookkeeping ensures well-maintained and organized records. This helps in easily retrieving crucial financial information and saves businesses from the stress of searching for documents during deadlines.

Enables Proper Reporting to Investors

Investors own a share in a company and are in a position to make effective decisions. They are mainly concerned about whether their money has been used properly or not. They certainly want to know if the company is making money or not. They also want to know what potential the business has. These aspects can be easily managed with bookkeeping. The profit and loss statement, which is prepared regularly, shows the profits and also determines the potential based on the revenue. The performance charts and various information can be easily prepared and documented. Thus, bookkeeping helps to avoid the hassles associated with reporting to investors.

Aids in Setting and Monitoring Business Goals

By keeping a close eye on financial records, businesses can set realistic goals and track their progress. This, in turn, fosters better decision-making and faster business growth.

Ensures Compliance with Government Regulations

Government regulations often require businesses to maintain financial records. Regular bookkeeping ensures that businesses stay compliant and avoid any penalties or legal issues.

Want to save yourself the stress of keeping in line with ever changing regulations?

Our accounting solution and dedicated accountant save you endless hours of trying to find regulations relevant for your business. Our A to Z accounting service is done professionally for only a low investment starting at just $42/month (billed yearly).

Offers Learning Opportunities

Whether you are new to bookkeeping or an experienced entrepreneur, engaging in bookkeeping practices helps in learning and understanding your business’s finances, thus making smarter business decisions.

Difference between Bookkeeping and Accounting

Bookkeepers record and organize financial transactions, while accountants analyze this data and prepare financial statements. Bookkeepers focus on the day-to-day financial activities, while accountants take a more analytical and strategic role, interpreting financial information for decision-making.

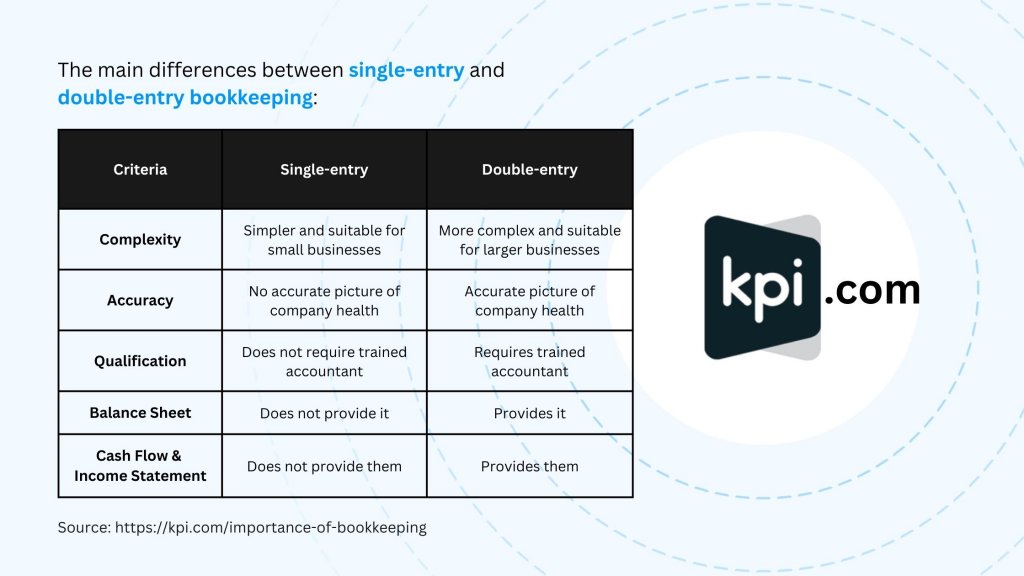

Single vs. Double-Entry Bookkeeping: What’s Best for Your Business?

There are two primary methods of bookkeeping: single-entry and double-entry.

Single-Entry Bookkeeping

Single-entry bookkeeping is simple and works best for small businesses with few transactions. It involves recording transactions once, either as an income or an expense. This method can be compared to maintaining a simple checkbook. However, it does not track assets and liabilities, making it less comprehensive compared to double-entry bookkeeping.

Double-Entry Bookkeeping

Double-entry bookkeeping, on the other hand, is more sophisticated and is generally considered the standard for businesses. It records each transaction twice – once as a credit and once as a debit. This system allows for a more accurate and detailed record of a business’s financial health, including assets, liabilities, equity, income, and expenses.

Here a table to better understand the main differences between single-entry and double-entry bookkeeping:

How to Get Started with Bookkeeping

Starting bookkeeping for your business involves a few critical steps:

- Choose a Bookkeeping Method

First, decide whether you will use single-entry or double-entry bookkeeping. Small businesses may start with single-entry, but as they grow, it’s advisable to switch to double-entry.

- Select Accounting Software

Today’s technology offers various accounting software to simplify bookkeeping. Some of them cost less but do not offer dedicated accountant services, others offer unnecessary extras and cost a fortune. At KPI, we offer a modular system that serves all your accounting needs. Pay only what you need.

- Organize and Categorize Transactions

Record all transactions and categorize them appropriately. Regularly review and update this information.

- Establish a Routine

Develop a routine for recording and reviewing financial transactions. This could be daily, weekly, or monthly, depending on your business’s size and the volume of transactions.

- Seek Professional Help if Needed

Don’t hesitate to seek help from an accountant or bookkeeper if you find managing your financial records challenging. If you are looking for a free walkthrough with the Accounting Solution by KPI, contact us today.

Conclusion

Bookkeeping is an essential aspect of running a successful business. It not only helps in maintaining organized and accurate financial records but also plays a vital role in financial planning, compliance with tax laws, and informed decision-making. By understanding its importance and incorporating best practices, businesses can ensure a solid foundation for financial management and, ultimately, foster growth and sustainability.

Frequently Asked Questions

What is bookkeeping?

Bookkeeping involves recording and organizing financial transactions, including sales, purchases, payments, and receipts. It is the process of keeping clear and concise records so that all financial information is easily accessible when needed.

Why is bookkeeping important for businesses?

Bookkeeping is important for businesses for several reasons, including making accurate budgeting possible, staying prepared for taxes, maintaining organized records, enabling proper reporting to investors, aiding in setting and monitoring business goals, ensuring compliance with government regulations, and offering learning opportunities.

What is the difference between bookkeeping and accounting?

Bookkeepers record and organize financial transactions, while accountants analyze this data and prepare financial statements. Bookkeepers focus on the day-to-day financial activities, while accountants take a more analytical and strategic role, interpreting financial information for decision-making.

What are the two primary methods of bookkeeping?

There are two primary methods of bookkeeping: single-entry and double-entry. Single-entry bookkeeping is simpler and involves recording transactions once, either as an income or an expense. Double-entry bookkeeping is more sophisticated and records each transaction twice – once as a credit and once as a debit.

How can I get started with bookkeeping for my business?

To get started with bookkeeping for your business, first, choose a bookkeeping method (single-entry or double-entry). Next, select accounting software to simplify the bookkeeping process. Organize and categorize transactions, and establish a routine for recording and reviewing them. If needed, seek professional help from an accountant or bookkeeper.