Wiki

Retained Earnings Journal Entry

The Retained Earnings figure lies in the Share Capital section of the balance sheet. It is an important financial term that reflects the portion of net income that a company retains after distributing dividends to shareholders. The journal entries associated with Retained Earnings ensure that corporate accounting records are updated appropriately at the end of each accounting period.

Understanding Retained Earnings

In essence, Retained Earnings represents the accumulated profits that a company has kept over time. This account is part of the Share Capital section of a company’s balance sheet and can be used for reinvestment in the business or to pay down debt.

Journal Entries for Retained Earnings

At the end of each accounting period, businesses close out their revenue and expense accounts, summarizing them into a temporary account known as the Income Summary Account. The net balance (revenue – expenses) of this account is then transferred to Retained Earnings through closing entries.

- If the company made a profit, Retained Earnings account will be credited (increased).

- If the company incurred a loss, Retained Earnings account will be debited (decreased).

How Retained Earnings are calculated

Suppose Company XYZ has the following revenue and expenses for the year:

| Account | Amount (USD) |

|---|---|

| Sales Revenue | 10,000 |

| Cost of Goods Sold | 4,000 |

| Operating Expenses | 2,000 |

Net Income = Sales Revenue – Cost of Goods Sold – Operating Expenses = $10,000 – $4,000 – $2,000 = $4,000

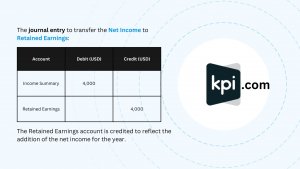

The journal entry to transfer the net income to Retained Earnings would be:

| Account | Debit (USD) | Credit (USD) |

|---|---|---|

| Income Summary | 4,000 | |

| Retained Earnings | 4,000 |

The Retained Earnings account is credited to reflect the addition of the net income for the year.

Have You Experienced the Full Potential of kpi.com?

Stay on top of your finances with real-time access to your general ledger, balance sheet, profit and loss, and cash flow statements. kpi.com offers monthly, quarterly, or annual management financial reports produced to local and international financial reporting standards.

Start at just $42/month (billed yearly).

FAQs on Retained Earnings

Q: What are Retained Earnings?

A: Retained Earnings are the accumulated net income of a company that is retained within the business rather than distributed to shareholders as dividends.

Q: How are Retained Earnings calculated?

A: Retained Earnings are calculated as the beginning Retained Earnings plus Net Income minus Dividends paid during the period.

Q: What is a journal entry for Retained Earnings?

A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or debiting (for net loss) the Retained Earnings account.

Q: Is Retained Earnings an asset?

A: No, Retained Earnings is not an asset; it is part of the equity section of the balance sheet, representing the amount of net income retained in the business.

Q: Why are Retained Earnings important?

A: Retained Earnings are important as they provide insight into how much profit a company has been able to retain for reinvestment or to strengthen its financial position. This can be crucial for growth, reducing debt, or weathering future financial challenges.

Q: Is Retained Earnings a debit or credit?

A: Retained Earnings is a credit balance account. It increases with a credit entry when the company earns profits and decreases with a debit entry when the company distributes dividends or incurs losses.

| Scenario | Effect on Retained Earnings | Debit or Credit |

|---|---|---|

| Company earns profits | Increases | Credit |

| Company distributes dividends | Decreases | Debit |

| Company incurs losses | Decreases | Debit |