Basic frameworks for accounting and bookkeeping

If you’ve ever been in business then you know at least something about accounting and bookkeeping. The finance department within any organization keeps money in order through the booking and reporting of transactions and tracking the flow of cash. Within the accounting world there are many frameworks, rules, regulations and practices, some of which we will discuss in this article.

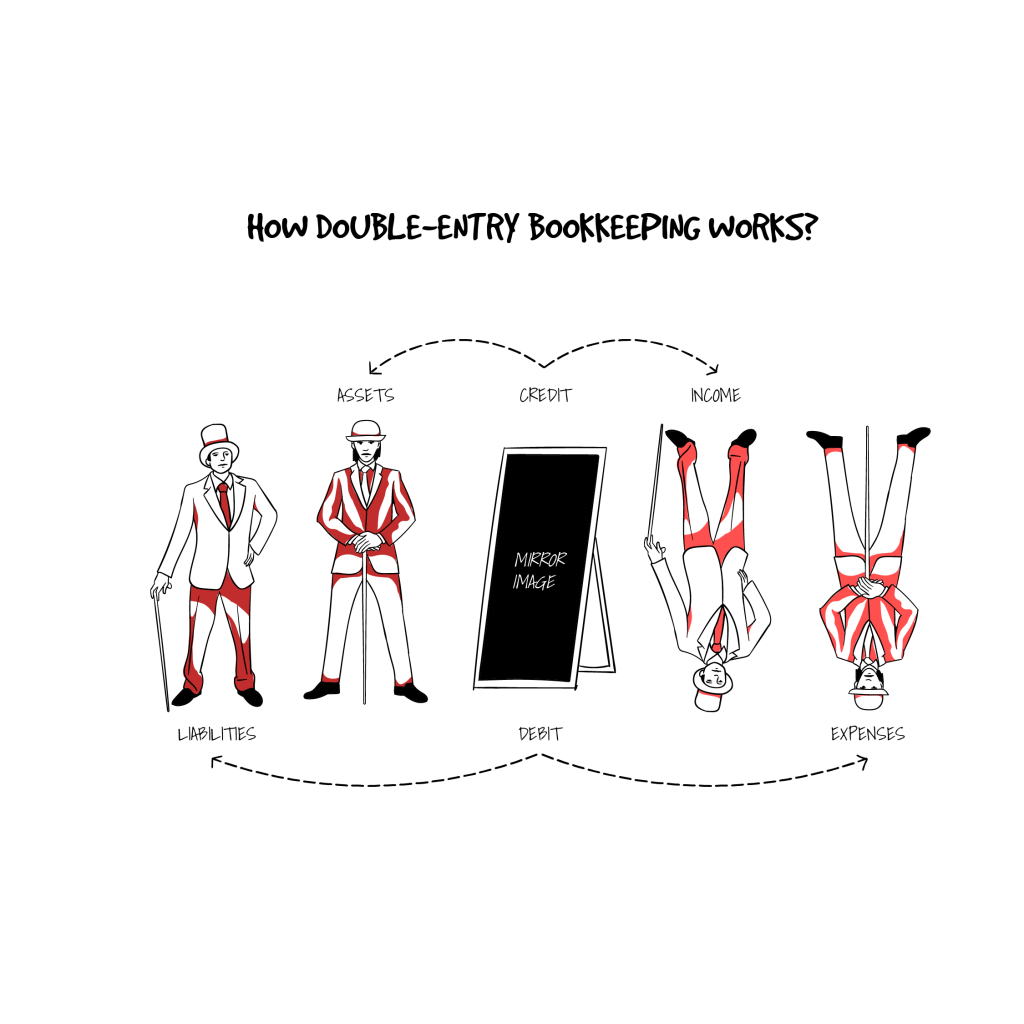

How double-entry bookkeeping works?

One of those principles is double-entry bookkeeping, which is a popular method among the accounting world. With double entry bookkeeping comes two-sided entries. For every one entry there must be another to equal out the first. The equation for this methodology is assets = liabilities + equity, which keeps the ledger in balance. This means debits have to equal credits, otherwise the entry is out of balance and will not work. In the accounting world, debits mean money is entering the general ledger and credits mean money is leaving.

The first example to demonstrate the double-entry bookkeeping could be starting out your business. To kick-off, you most likely have to deposit cash in your new business account. Recording that entry would be a debit to cash, increasing your cash balance, and a credit to your liabilities side.

Now, let’s use another example for a double-entry transaction. Say if you have a loan on the books, that would obviously be a liability and you have the cash to pay that note, which is an asset. If you make a loan payment, you would debit your liability and credit your cash.

Our final example of the double-entry method in accounting will be for physical assets. If your business has the equipment – it’s an asset. When the time comes and you need to sell this asset, you would credit your asset general ledger and increase your cash line item.

A reason to implement this type of accounting practice is it keeps a detailed record of your transactions. While this is important to always maintain financial detail, it can allow you to track the flow of money better and provide information when an audit occurs. Depending on the size of your business this may be a small ledger, while larger companies can have a large and in-depth account book.

At the end of the day, everything has to balance out to zero. Many departments will reconcile monthly, ensuring general ledgers balance before closing books for that month. If the ledgers do not match, you’ll need to reconcile and find where the mismatch is.

Double-entry bookkeeping is a popular method and many businesses utilize the practice. There are endless resources on how to implement the double-entry bookkeeping in your business, that can be an effective way to track the company’s finances.

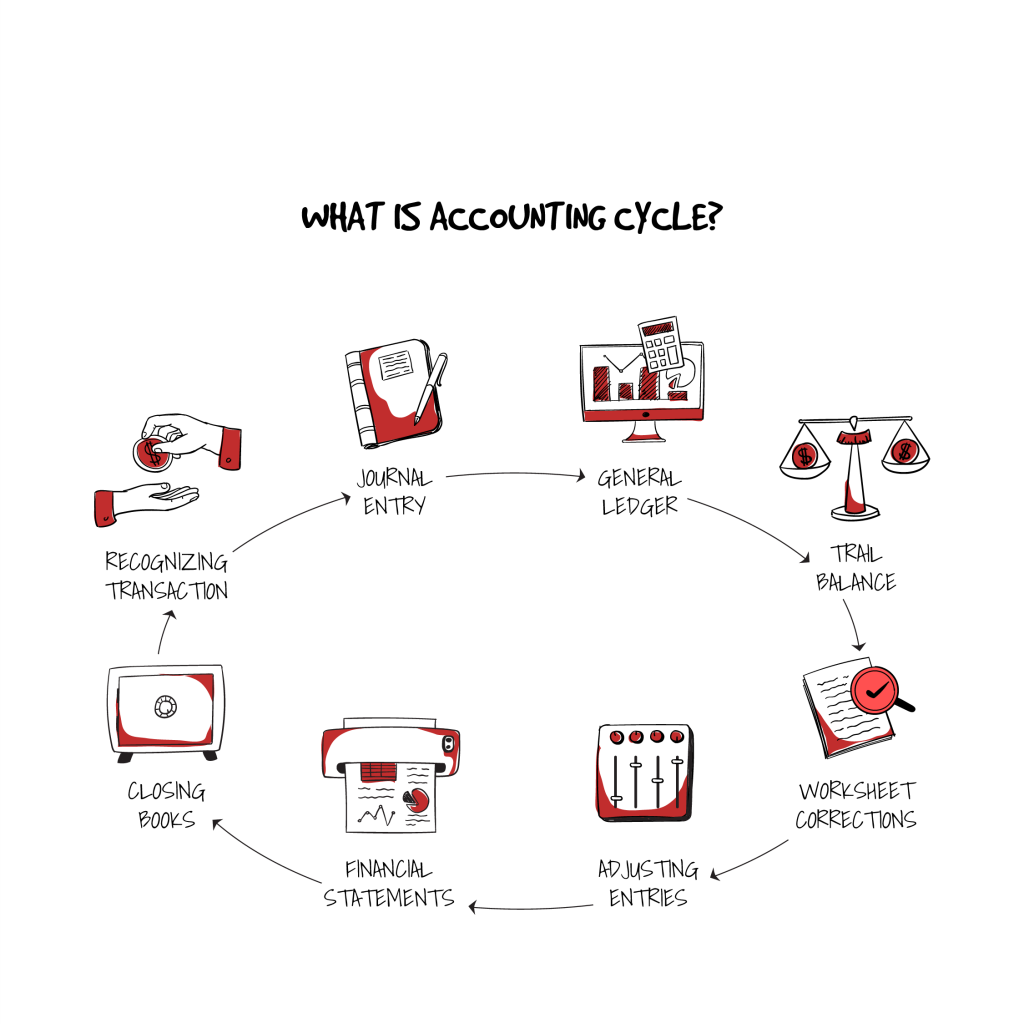

What is accounting cycle?

Whether you are the consumer making purchases or the business supplying them, there’s one thing both have an impact on, and that is the accounting cycle. The accounting cycle is how a business keeps track of all money flows, transfers and accruals.

Think of it as one large book where anytime money moves, it must be documented where it came from and where it went, zeroing out in the end. This article will go over the eight-step cycle and dig into how the accounting cycle works.

Recognizing transaction

First is the transaction, which is when a business accepts any sort of payment for a good or service. Another transaction could the company paying off a debt or settling a utility bill. No matter the transaction, this is where the process begins – recognizing it.

Journal entry

Next comes the journal entry, which is when the transaction is documented in the accounting ledger. This is how transactions are categorized and documented to ensure they are recorded and published in the future correctly.

General ledger

Once the transaction is written on an entry page, the journal entries are then posted into the general ledger. This is typically handled in accounting software or spreadsheet, correctly posting the transactions to their specific general ledger. Posting is still done manually in a smaller business, but many have moved to an electronic platform.

Trial balance

Trail balancing is when at the end of the month or certain accounting period, the books are balanced to ensure there are no more or less debits than there are credits. If that is the case, the books must be reviewed for the error to be identified.

Worksheet corrections

In the event that the trial balance does generate an error, the worksheet is where you’ll be correcting the discrepancy. You will work out the differences here, showing where the difference occurred and how it will be rectified.

Adjusting entries

Once the worksheet is completed, you will go ahead and make the adjusting journal entries. This can either be done retroactively or posted at the end of the period with an explanation stating it is a corrective entry.

Financial statements

The culmination of postings and trial balances will lead you to the financial statements. After everything has been reviewed, final numbers will begin populating income statements and balance sheets. These are used in monthly, quarterly and annual reviews, which determine the financial wellbeing of the company.

Closing books

Lastly, after everything is finalized, it is time to close the books. This is when numbers are declared final and the statements can be published to the appropriate groups.

This process seems quick but there are many moving parts and it can be intricate. However, it is necessary to ensure the organization runs well and every expenditure and movement of money is tracked properly.

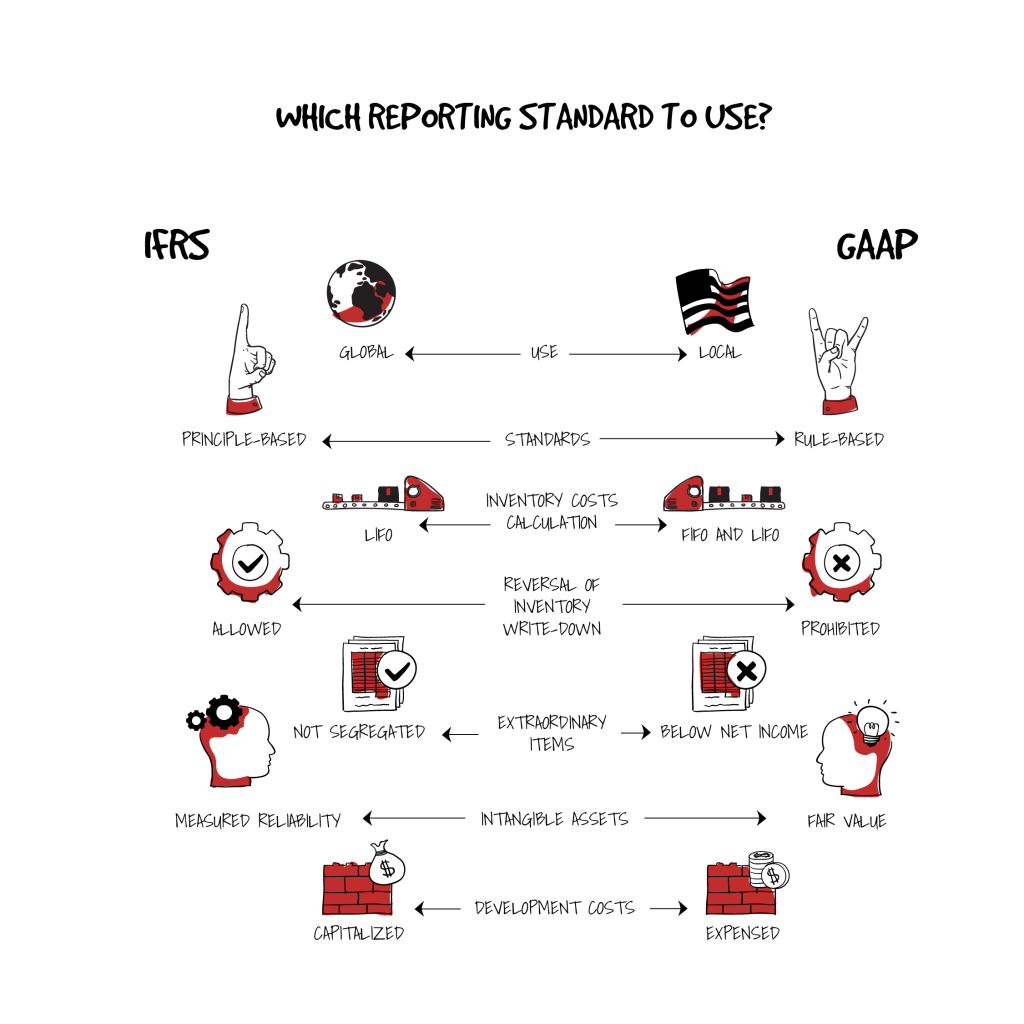

Which reporting standard to use?

In the world of business, depending on your location there are two major standards of accounting that are used. The two standards are the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP). IFRS is the most widely accepted standard for accounting, being used in over 110 countries. GAAP is mostly used in North America and is known colloquially as accounting standards and varies from one jurisdiction to another.

No matter which you select, your business must adhere to their guidelines and practices. Otherwise, you risk fines, as well as not being a transparent business, which can impact future financing endeavors. This article we’ll cover information on how the standards work.

Economic entity assumption

This standard states that transaction is to remain separate from other business owned by the same individual. For example, if you own a business selling electronics and another selling furniture, each business will report separate financial statements, allowing investors and current executives compare the business against competitors.

Going concern assumption

This assumption states that the financial activities of the business will carry on indefinitely. For example, if you are an oil company it assumes oil will never run out or if you are a manufacturer that your business will never cease to operate. Doing so allows investors and management to have a long-term outlook on the business.

Time period assumption

Another assumption is the time period assumption, which states different operations of a business can be divided into arbitrary time periods. An example is a sale of a widget, which can be measured daily, monthly or quarterly. The benefit is it allows for easier financial reporting.

Full disclosure principle

This standard states that any information, past, present or future that may impact financial performance must be disclosed. Crops are a perfect example in that if you know a natural disaster has damaged crops for the next year, you’ll have to disclose the impact it will have on your financials.

Historical cost principle

When documenting cost, this standard forces you to value assets and liabilities at their buying price. If you bought an asset 10 years ago for $1,000 but it’s now worth $10,000, you will still put the stated value of $1,000 on your books. The goal with this standard is to refrain from overvaluing assets.

Principle of materiality

Lastly, there is the principle of materiality which states accountants may make a professional decision to go against any one of the other principals. An example would be taking a one-time expense instead of amortizing it over the useful life of the product. This practice is used for smaller items that are near insignificant.

There are endless standards, but these are simply a few high-level ones to abide by. Within each standard are multiple ways to record certain items. The overarching goal with accounting standards is to encourage constancy and transparency.

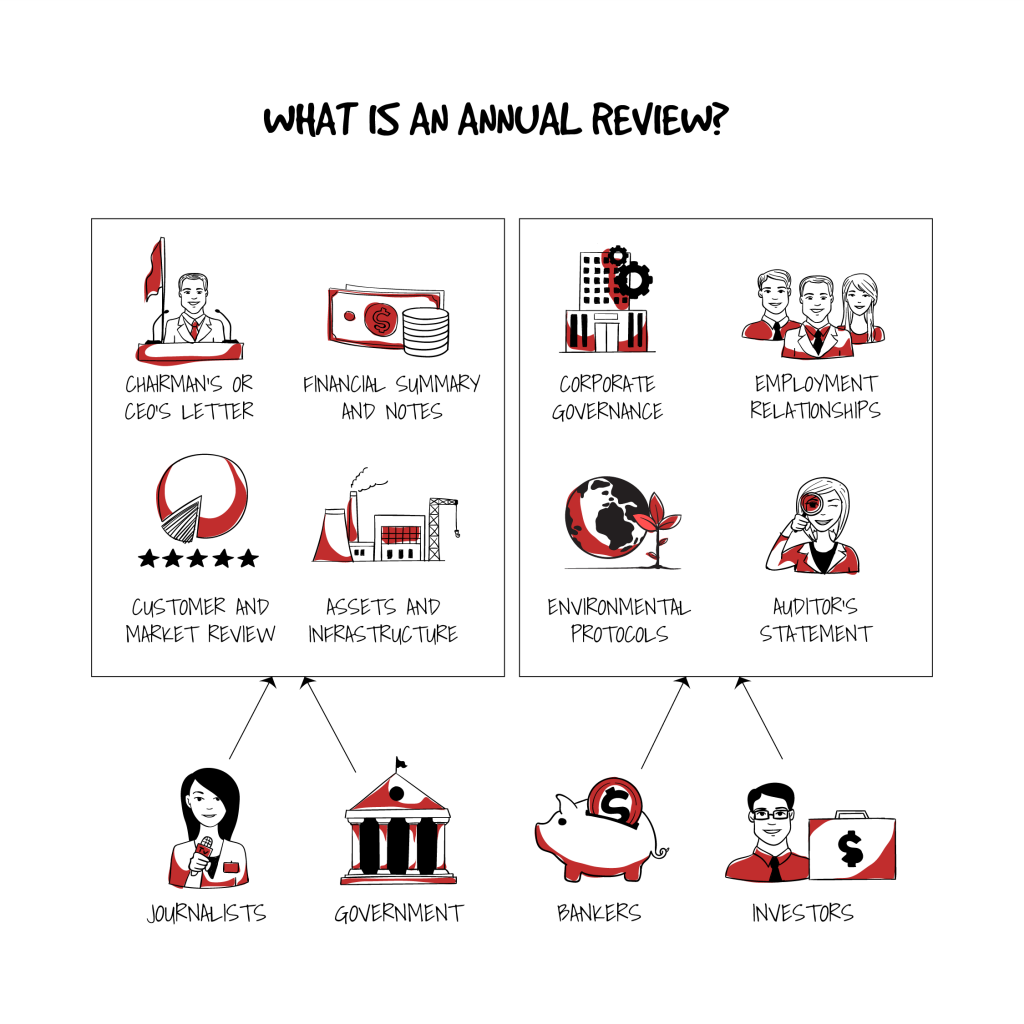

What is an annual review?

An annual review is when a company makes a presentation at the end of its fiscal year. For public companies, this is reported for everyone to see, allowing current and potential shareholders to view the health of the organization. If the company is private, this may only go to the board of directors and a few senior staff members.

Regardless of the type of company, this review is done annually to ensure financial well being and to plan for the upcoming year, via budgeting, milestones and projected revenues.

Contents of an annual review

Typically you’ll find in an annual review coverage of the three big statements, which include the balance sheet, the cash-flow statement and the profit and loss statement or income statement. These statements will tell you almost everything you need to know about the company at a surface level. During an annual review is when questions will be asked specifically regarding the various statements.

Alongside the important statements, you will also be told about performances, employee information and the overall well being of the organization. This can tell you vital information as well because employees and performance is the lifeline of an organization. Other information you will find are any legal happenings or any potential risks to the business. If you look at a publicly traded company, you can find a whole section dedicated to risks.

Deconstructing financial statements

Typically if you are in one of the numerous stakeholders’ positions, you will receive the financial information prior to the annual review meeting. This is when you’ll take the time to deconstruct the financial statements and find any information that doesn’t match.

The balance sheet shows what the business is worth at the reporting time which is typically the last date of the company’s fiscal year. It will tell you the assets, liabilities and the equity within the organization. When you review this, you will likely be comparing against budget numbers and forecasts. If something is too out of line, it will certainly be brought up in the annual review financial meeting.

Readers of annual reviews

As mentioned, there are many people who get to see the annual review report. The first are the shareholders who are financially invested in the company. They are the ones who are going to want to know everything about the company, is it doing well or poorly.

From there you have the employees who are extremely interested as well because this is how they earn a living. They want to know the company they work for is economically and financially sound.

The final key group includes auditors, government entities and financial institutions. Auditors want to ensure you are obeying regulations, the government wants you to pay taxes and financial institutions won’t lend without solid financials.

Annual reviews are critical to an organization and are not taken lightly. No matter if you are a shareholder, an employee, a banker or a taxman, these reports and meetings are reviewed and monitored closely to ensure the wellbeing of an organization.

How to read financial statements?

Knowing how to deal with the numbers in a company’s financial statements is a necessary ability for business owners and managers. The meaningful interpretation and analysis of balance sheets, profit and loss, and cash flow statements to determine a company’s financial standing is the solid foundation for smart investments and informed business decisions. In this short article, we’ll show you what the financial statements contain and how to decode and to read them.

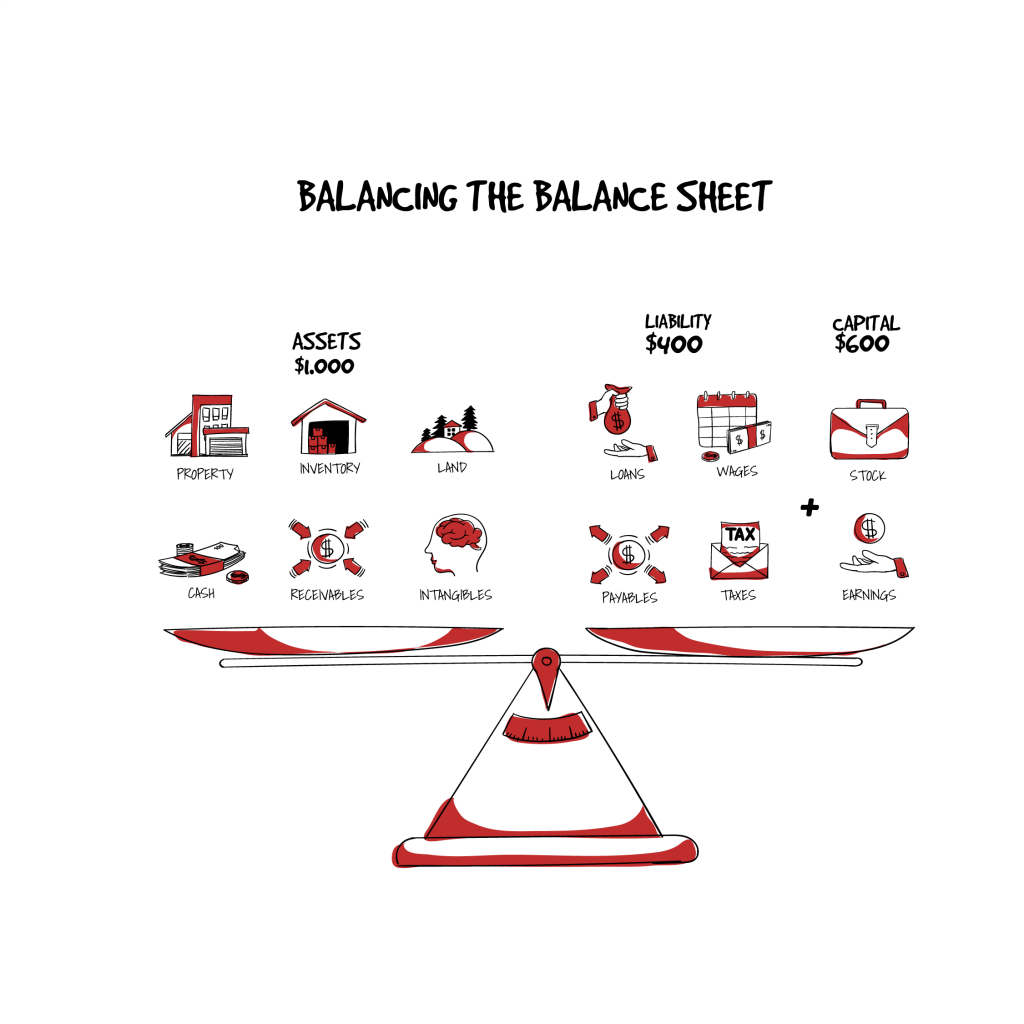

Balancing the balance sheet

One of the important and most notable financial statements is the balance sheet. A balance sheet is a financial statement that shows what a business is worth at a specific point in time. Within the balance sheet, you will find assets, liability, and shareholders equity of the business.

When putting together the balance sheet, everything must have an equal and opposite entry. For every debit there must be a credit, every asset – capital. From an analytical standpoint, this is where you can see everything a business has on its books. If you use this statement in conjunction with a cash flow statement, you can begin to paint a big picture of how the business is doing.

The balance sheet equation is an accounting formula that is the basis of double-entry bookkeeping. It shows a relationship between assets, liabilities and owners’ capital. How the equations work is simple.

In the first example, this is a company that has no liabilities. Currently, the business has $1,000 in assets, which means their capital must equal the assets. In numbers, it would be $1,000 in assets equals $0 in liabilities plus $1,000 in the capital.

The second example will be the business incurring some liabilities. In this one, the business has spent $400 on a sign. Now, the equation reads $1,000 in assets equals $400 in liability plus $600 in the capital. Even though money has shifted the equation remains in balance.

First are fixed assets, which are non-liquid, meaning they cannot be sold quickly and turned into cash. This could be machinery used to make widgets, the current infrastructure, and land. The number alone may not mean much, but if it is larger compared to liquid cash or smaller than debt, you may want to research why.

From there, you can see current assets and those are assets that can be sold or converted into cash quickly. This includes inventory or vehicles, which take little to no time to liquidate in normal market conditions.

Then you’ll run into the creditors’ section, which are entities the organization owes money too. If this number isn’t noticeably large, then it’s likely acceptable. However, there should be some loans here because they can free up cashflows, which can be used to fund revenue-generating actives. When this line item grows out of control is when you should be concerned.

The final line item to watch is the net assets, which are assets less liabilities. Depending on the life of the business, this number may be negative at some point. However, the long-term goal is to ensure assets always stay larger than debts.

The balance sheet is a powerful statement, especially if used alongside a cash flow statement. With those two reports in hand, you can essentially see how a business is doing internally. From these reports are where you’ll derive questions about performance and sustainability going forward.

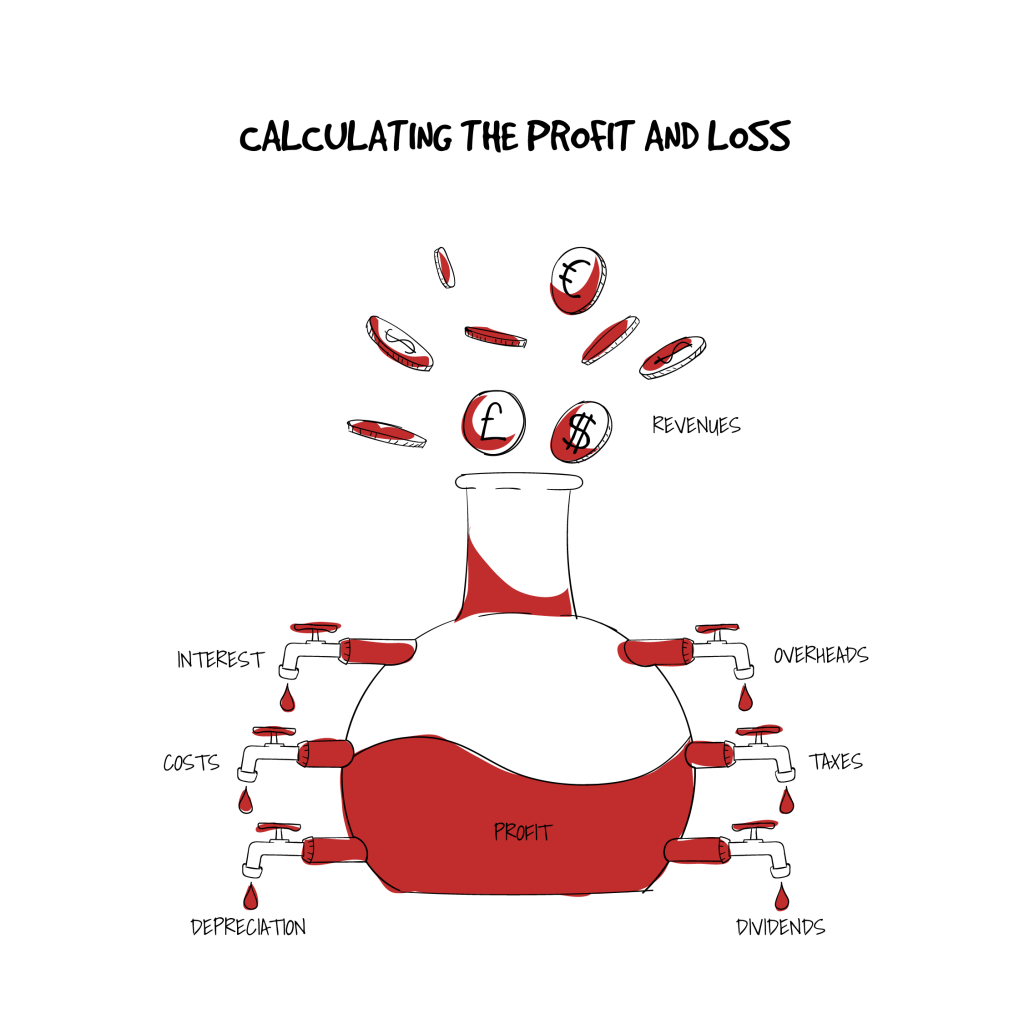

Calculating the profit and loss

No matter if you’re investing in a publicly traded company or a small private firm, one of the reports you should know how to read is the income statement. This statement is put in with the monthly, quarterly and annual reports.

The purpose of the income statement is to demonstrate the profitability of the business through gains and losses. It’s beneficial to compare the report annually because it will show any areas that change dramatically. If you are an investor, this will be a powerful tool in deciding if the company is worth your money.

When looking at an income statement there are several line items that can begin telling a story. However, a couple you’ll want to narrow in on include turnover or revenue, as well as operating profit.

Revenue is the blood of a company. Without revenue, for a sustained period of time, the organization will slowly begin to fall. Certainly, a business that misses revenue targets from time to time can still be profitable, as long as it isn’t systemic and supported by one-time costs.

While you may not be able to get granular with this section, expenses are something to monitor if you are investing or even an employee of an organization that publishes numbers. Within the expense category, it can include the following:

- Payroll

- Utilities

- Insurance

- Telecoms

- Advertising

- Legal Fees

- Interest Expense

- Taxes

- Entertainment.

If a company is growing, then you will naturally see payroll increase. You will also see utilities and insurance growing as well. However, if you see entertainment, as well as legal fees, growing disproportionately, you may want to read deeper into an annual report or submit a question to the management.

Other parts of the income statement to review include profit margins, operating expense, and taxes. These will all have a direct impact on the bottom line or the net income.

If there is one report you should look at the income statement should be near if not the top of your list. This will give you insight into the health of the organization and if there is any reason for concern. The income statement will be closely linked to the balance sheet and the cash flow statement.

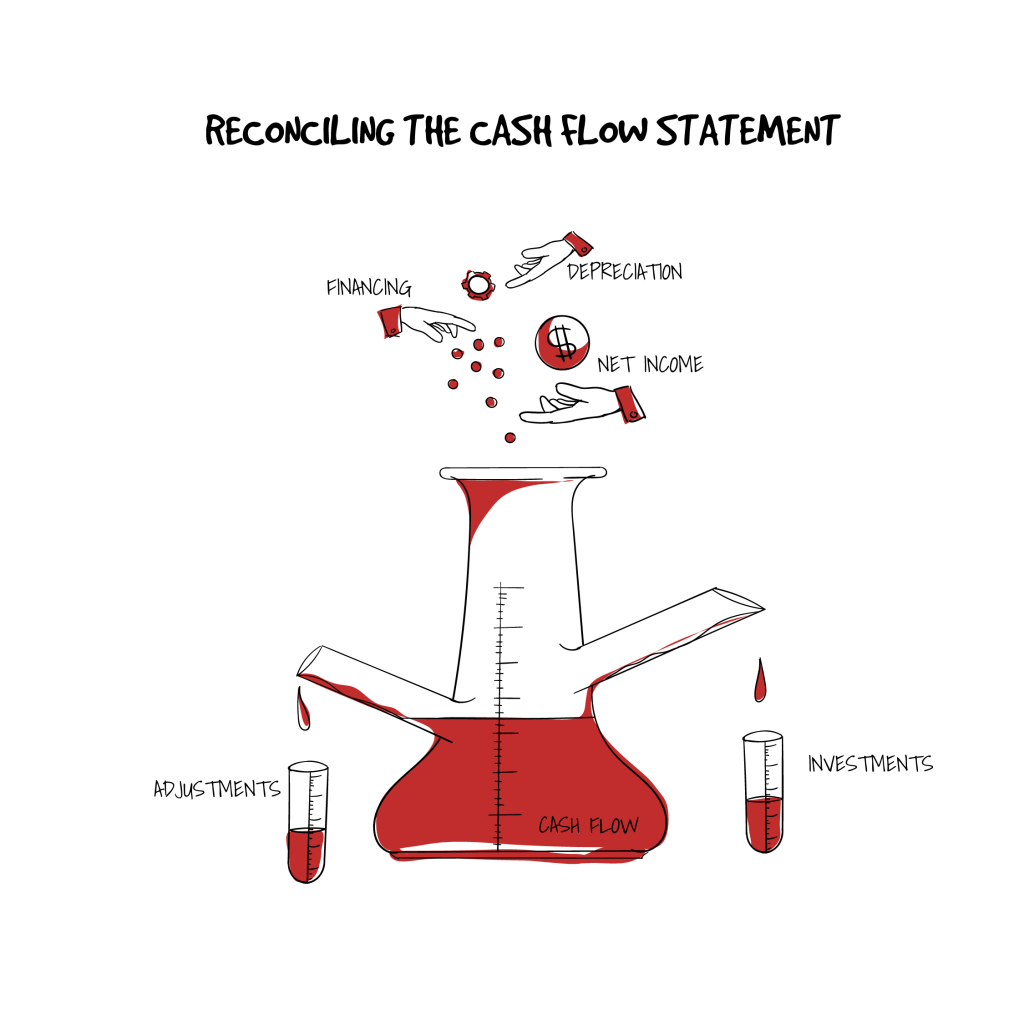

Reconciling the cash flow statement

There a handful of financial reports that are essential to a business and the cash flow statement is one of them. Your ability to read and understand the cash flow statement will give you insight into where the money is going and how the business is doing fiscally. An analogy would be the cash flow statement is a map of the business’s bloodstream.

Reading a cash flow statement is simple and can be broken down into a few parts. Once you break it down, you can read it section by section, like a book. There are a few sections to take note of when analyzing the cash flow statement.

The first is the return on investments, which should be a positive number if healthy. Certainly, there are exceptions to when this line item may be negative, but you should consistently see it positive and even increasing.

Second, are the business capital expenditures or capex for short. This is the sum of the purchases and sales of tangible assets. Though there might be some periodical highs and lows, you want this number to be consistent and not fluctuating wildly.

The final section to watch is financing, which is exactly as it sounds. This could be financing of a project or bonds that were issued to fund an asset purchase. This number should not get too out of hand because it can be a sign of increased leverage.

In summary, there are three types of cash flow:

- Cash flow from operating activities. The equation is first taking revenue minus the cost of sales. Once you’ve arrived at that number, you will take that, subtract taxes, add in depreciation, add any changes in working capital, and this will equal your cash flows from operating activities.

- Cash flow from investing activities. This equation is aimed at the buying and selling of assets or investments. When this equation is typically calculated, it will be a negative figure, meaning more cash outflows than inflows. However, it can sometimes be positive.

- Cash flow from financing activities. The final type of cash flow includes buying or selling a stock, as well as paying out debt or dividends. You will typically see money come in if something is sold or money going out if an asset is leased or financed.

When analyzing the cash flow statement, you’ll want to pay attention to inflows and outflow. Typically you want a healthy balance or inflows outweighing outflows consistently.

Outflows will include wages and compensation, overhead, loan repayments, taxes and paying suppliers. While these are all operational costs, they need to remain in check compared to the overall business.

Inflowing include loan proceeds, sales or revenue, and financing activities such as stock or bond issuances. Ensuring the inflows are from healthy sources and not all financing is critical.

If there is one statement to know well it’s the cash flow statement. This will tell you the health of the business and how money is flowing. Noticing an issue can be a red flag of something operationally that needs to be fixed.

If you look at the transcripts of the annual meeting call you will find at the end investors asking questions on the company. Looking here is a great way to begin researching potential questions you may have or reasons for certain occurrences.

How to master your management accounting and budgeting?

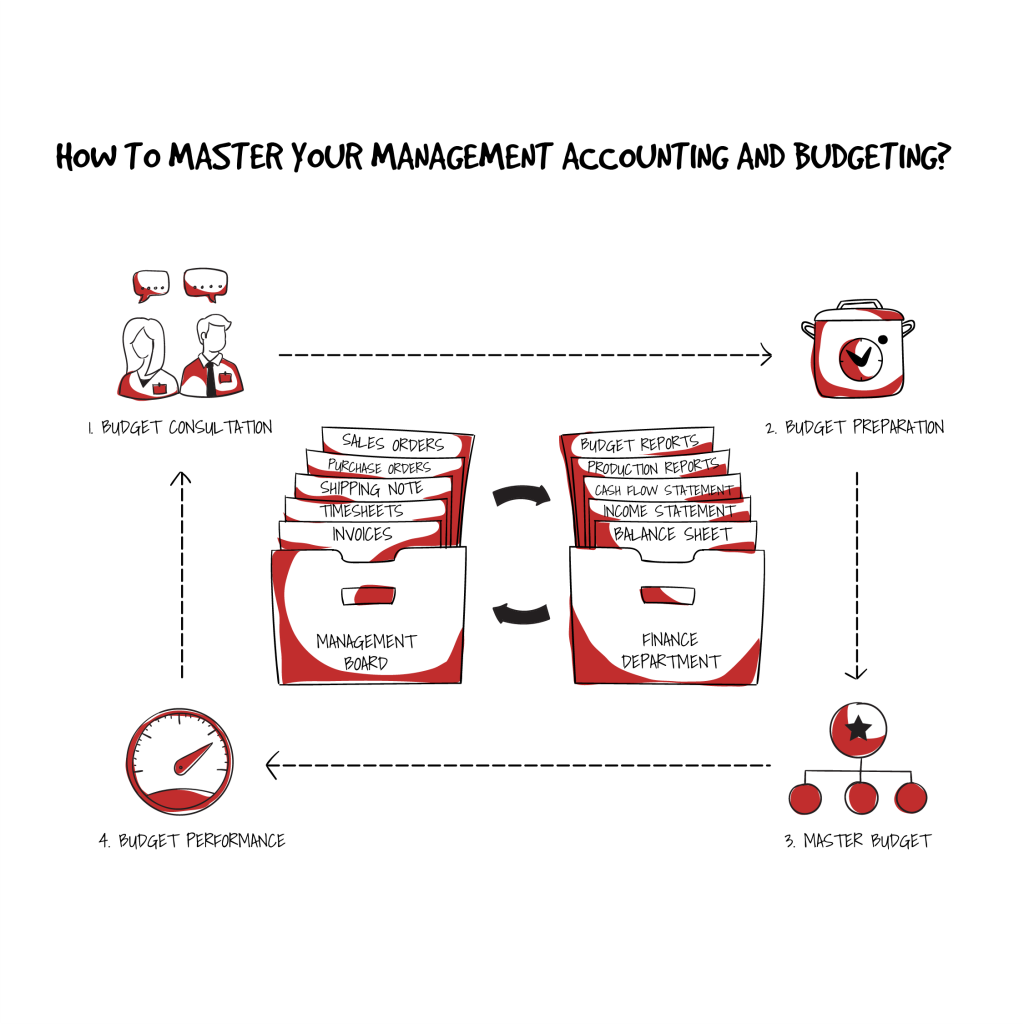

Finance department is arguably one of the most central parts of an organization. It tracks all money movements, budgets and every last thing that has to do with money. Management accounting is exactly what it says on the tin, and that is to keep track of the happenings with the finances of an organization from a managerial standpoint.

Management accounting includes budgets, timesheets, and orders, which are all necessary for an organization to operate. Another term for management accounting you may hear is cost accounting. This article will go into further detail on what exactly management accounting is.

Cost accounting is critical because it ensures the organization is operating in an effective manner. Furthermore, it’s a check and balance for when budgets are set that individuals and departments are adhering to them. While this is a fluid process, by sticking to the numbers it helps the overall organization focus on funneling cash elsewhere, promoting growth.

Budgets

At the beginning of each fiscal year, a budget is put together. This is done with the aid of departmental managers who put together departmental budgets. A budget should include everything from educational expenses to supplies needed to operate. Throughout the year, departments must attempt to maintain their budget and stay within the estimated numbers. By doing so, the accounting will stay on track and allow the business to focus on other items.

No matter if it’s a dollar in your pocket or billions of dollars of the largest corporation in the world, budgeting is essential in maintaining a healthy financial state. Budgets can be as detailed or as general as you’d like, but the goal of a budget is to ensure the business stays on track and profitable.

Budgets are broken down typically by departments and then broken down by sub-departments. The goals with this are it allows managers to report their budgets and executives to identify if a certain area is missing or hitting budgets, which have a direct impact on the bottom line. In this article, we’ll go over the general steps on setting and implementing a budget.

Orders

Next are purchase orders, which are a form of payment that will need to be sent to a supplier. Management account would tell the finance department how much will need to be set aside in order to fund the purchases. This goes along with the budget, in considering expenses a department may need for the year. If spending gets too out of hand it can cause cash flow restrictions.

Timesheets

For those that are working and billing on an hourly basis, they will be filling out timesheets, which ensures the employee is paid properly and expenses for the organization are tracked. Salary employees are easy to track because the costs are constant throughout the year, with the exception of one-time bonuses.

Management

Department managers receive statements such as the cash flow, balance sheet, and budget reports from finance department. These statements are typically done in an analytical way, so the managers can see any issues and are aware of how they are doing in real time. From there, managers will pass their findings and requests back to the finance department. Then new reports are generated and the cycle can repeat again.

Consultation

The first step is getting senior management together to discuss the direction of the business. From here, this is where the budget process begins. Once the high-level numbers have been established, they are passed down to the appropriate managers for review. It is then up to the managers to build detailed budgets based upon their expected needs and costs. By narrowing in on the operational costs of each department, senior management gives the numbers to the finance department so it can work with on building financial reports.

Preparation

When a budget is created, it is usually constructed based on the fiscal year of the organization. However, it is likely to be broken down into smaller time frames such as months or quarters. Once a budget has been constructed by the department managers, they are submitted back to senior management for approval. There will likely be dialogue on costs and reasons for certain numbers, but as long as it’s justifiable it should be good to go. Preparation of the budget should include educational expenses, supplies and other items needed to operate efficiently and effectively.

Master budget

After all the departmental budgets have been approved, there is one large master budget. This includes everything and is used as a global figure to stay within. Those who are able can typically view a monthly cash flow statement and balance sheet to keep up with current numbers. Also, many organizations will send updated budgets throughout the year to let managers know where they stand.

Performance

Measuring performance is simply taking the actual figures and comparing them against the budget. The goal is to stay as close to the budgeted numbers as possible. However, if numbers are substantially off the targets there are typically changes made to the budget. Depending on the magnitude of the deviation, a revised budget will be issued to reflect a more realistic figure to work with.

A business without management accounts and budgets is destined for failure. Without these basic financial tools, it’s extremely difficult to hold departments accountable and it encourages frivolous spending. Instead, having a well-thought-out plan of attack will ensure a business runs smoothly and efficiently.

How to detect financial fraud?

It’s safe to say that most businesses experience fraud in one manner or another. For example, if you are in the banking industry you experience fraud through your clients. When a client experiences fraud, the bank will typically reimburse fees back to the clients. If you are in retail, you may experience theft, which in turn is loss of money.

Being able to track fraud is important because you want to ensure your business is not heavily impacted by fraud, so much so that you’re losing large amounts of money. In corporate finance, fraud is typically found by analyzing one of the major financial statements.

How it works

Public companies are required to have their annual financial statements reviewed by an independent auditor. Throughout this process, it is the organization’s duty to ensure all data was posted properly. If the auditor finds any suspicion of fraud, they will escalate the matter, with the goal of finding a solution to the fraud.

Should there be any information found, it will be brought to senior management’s attention and the auditor will either continue working if it’s severe enough, or the need for a forensic accountant may be requested. There is plenty of example such as Enron where the fraud was so bad it brought down a whole organization.

Red flags

To the trained eye, red flags can be noticed and brought to the top. From there, a plan of action is created to find where the fraud may be stemming from.

Some red flags to watch for are related to cash flows. If you see that the cash flow statement has been posting negative numbers consistently then there is a large jump to a positive number, that can be a red flag.

Another red flag could be a large increase in sale or sales being recorded before they’ve been made. This can add up quickly because if the sales fall through, not only did you report these sales, but you have to explain why they were prematurely entered into the books.

A final red flag includes any senior or executive management that begins ignoring certain questions are becomes stressed during certain topics of conversation. This could indicate they know something about the issue but are not willing to divulge details.

Analysis

To aid in the fraud detection process, take time to research items such as ratio analysis or completing a surprise cash count. If a ratio is suddenly out of alignment, that means an underlying data point has drastically changed. With the surprise cash count, it doesn’t leave time for a potential fraudster to move cash or hide certain numbers.

The earlier fraud is caught the better, as it limits damage to the company and its employees. With the case of Enron it took the whole organization down. If you ever think you’ve found suspicious activities, take the time to report it to your manager. Also, ensure you follow up to know it’s being dealt with accordingly.