KPI: All-in-One Business Management Solution is a powerful software designed to streamline business operations and track key performance indicators (KPIs).

KPI apps provide solutions for all your business needs that are cloud-based and easily integratable with over softwares. Whether business needs are in accounting, sales, payroll, HR, project management, reports and documentation, KPI will cover it.

KPI is trusted by 700+ Customers Internationally in 50+ Countries in varying industries. Unlock international markets and breakthrough industry barriers with KPI. At KPI your business needs are important to us and all limitations are removed to support your growth and success.

KPI integration is simplified and can be done simply with KPI tech support. No need to worry about adding data manually, all of the integration is done by the KPI tech support with care and attention to the details.

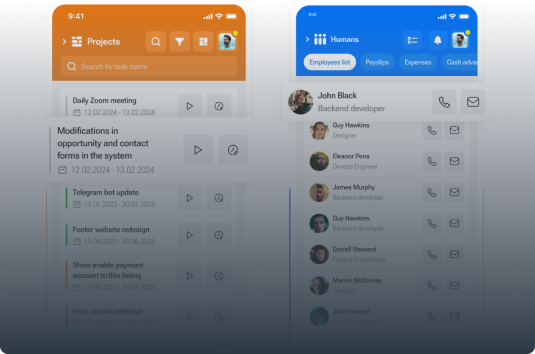

Utilize all KPI apps on your mobile device to stay connected from anywhere. Gone are the times where productivity and work has to be done on a computer. Unlock and enhance business productivity with employees and stay on top of work on the go.

Can I use only one KPI application or I have to use all?

Yes, KPI applications are cross-functional and work best together, however, if you only require one application you are able to use the application which you desire. Our sales team is there to help and advise you regarding which applications would work best for you and your business.

What if I have special requirements for the KPI interface?

KPI, provides customization which is according to your business needs. You will have the ability to customize completely to your liking. Our support team is always available to help you and identify and understand your needs.

Can I integrate third party applications with KPI?

Yes, KPI seamlessly integrates with most third party applications.

How can I file taxes with KPI?

Within the KPI accounting app you are able to generate VAT reports which allow you to calculate VAT payments without having to use any third parties. KPI has integration with HMRC in the UK, VAT filing in the UAE and ZATCA in Saudi Arabia. This enables you to go directly to the tax filing authorities and make your payments online without having to worry about worrying about calculating payment amounts.

Can I authorize employees to do managerial tasks within KPI?

KPI enables business owners and executives to focus less on administrative tasks and more on scaling their business. Simply authorize employees to undertake managerial tasks with permissions such as payroll, tax filing reports, HR related queries, projects, and much more.